Republicans in Congress Want to Put $1,000 Tax on EVs, & Kill the EV Tax Credit

CleanTechnica EVs

FEBRUARY 14, 2025

continued] The post Republicans in Congress Want to Put $1,000 Tax on EVs, & Kill the EV Tax Credit appeared first on CleanTechnica.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CleanTechnica EVs

FEBRUARY 14, 2025

continued] The post Republicans in Congress Want to Put $1,000 Tax on EVs, & Kill the EV Tax Credit appeared first on CleanTechnica.

CleanTechnica EVs

MARCH 18, 2025

continued] The post Elon Musk May Need to Recalculate His Opinion on EV Tax Credit Repeal appeared first on CleanTechnica. On the campaign trail last year, asked about US EV subsidies, Elon Musk said that he was opposed to all subsidies and would be happy with both EV and fossil fuel subsidies being removed.

Green Car Congress

APRIL 11, 2019

US Senators Debbie Stabenow (D-MI), Lamar Alexander (R-TN), Gary Peters (D-MI), and Susan Collins (R-ME) along with Congressman Dan Kildee (MI-05) introduced the Driving America Forward Act, bipartisan legislation to expand the electric vehicle and hydrogen fuel cell tax credits. ITC Holdings Corp.,

CleanTechnica EVs

FEBRUARY 14, 2025

As I just wrote, the wheels are now in motion to kill the US EV tax credit (or, well, all three of them the $7,500 one for certain new EV purchases, the $7,500 one for EV leasing, and the $4,000 one for used electric cars). One would think that.

CleanTechnica EVs

FEBRUARY 1, 2025

At the moment, the US Department of Energy (DOE) and Environmental Protection Agency (EPA) indicate that the following fully electric vehicles are eligible for the $7,500 US ZEV tax credit: Acura ZDX Cadillac LYRIQ Cadillac OPTIQ Chevrolet Blazer EV Chevrolet Equinox EV Chevrolet Silverado EV Ford F-150 Lightning Honda Prologue.

Green Energy Consumers

MARCH 18, 2025

Back in November 2024, we wrote about the incoming federal administrations intention to do away with the federal tax credit for electric vehicles (EVs). Were now well into tax season in 2025, and the federal tax credit is still in existence for now.

Green Car Congress

DECEMBER 19, 2013

introduced the latest in a series of discussion drafts to overhaul the US tax code. This new staff discussion draft focuses energy tax policy on stimulating domestic, clean production of electricity and transportation fuels, which account for 68% of energy consumed in the US. Senate Finance Committee Chairman Max Baucus (D-Mont.)

Green Car Reports

MAY 2, 2024

Treasury Department could issue clarifications on federal EV tax-credit eligibility rules as early as Friday, reports Transport Topics. Citing anonymous sources familiar with the matter, the report claims the federal government is ready to issue rules relating to its "foreign entities of concern" requirement.

Green Car Congress

FEBRUARY 21, 2014

California Senate President pro tempore Darrell Steinberg proposed a carbon tax on fossil transportation fuels to replace the coming cap and trade mandate on that sector in 2015. In 2020, the tax is estimated at 24¢/gallon—lower than the upward price risk under cap and trade at 40¢/gallon. A carbon tax is stable.

Green Car Reports

FEBRUARY 11, 2018

Fears that Congress would kill the federal tax credit for purchase of a plug-in electric car were laid to rest in December when that incentive survived the $1.5 billion tax-cut bill.

Green Car Reports

AUGUST 5, 2019

After Canada introduced a nationwide $5,000 tax credit for electric cars, sales shot up by 30 percent, the country's Transport Ministry announced on Thursday.

CleanTechnica EVs

NOVEMBER 28, 2022

Changes to the federal tax credit for electric vehicles have introduced lots of new provisions. Here's what we know so far.

Green Car Congress

AUGUST 10, 2021

In an effort to decarbonize transportation and reduce aviation emissions, Congress is considering new legislation to establish a tax credit to promote and develop robust domestic SAF production. We urge you to make the US Department of Energy (DOE) the lead agency in establishing a regularly updated LCA for any SAF credit.

Teslarati

OCTOBER 28, 2021

However, EV enthusiasts are interested in the potential reintroduction of the EV tax credit, which is set to increase to a possible payout of $12,500 per electric car from the previous $7,500. The EV tax credit has been speculated upon since early 2021 as the terms of the incentive were still in the early stages of being determined.

CleanTechnica EVs

MAY 27, 2021

The US Senate Finance Committee has put forth a bill to extend and strongly improve the US federal EV tax credit.

CleanTechnica EVs

AUGUST 9, 2022

Rivian think it's figured out a way to get pre-order holders a $7,500 tax credit.

Green Car Congress

DECEMBER 22, 2013

Minor changes to an existing Federal tax incentive for second-generation biofuels (i.e., Minor changes to an existing Federal tax incentive for second-generation biofuels (i.e., The study identified four specific changes to the US tax code that could help accelerate the commercialization of second-generation biofuels.

CleanTechnica EVs

DECEMBER 27, 2022

Fitzpatrick (R) of Pennsylvania, that would provide a $2500 tax credit for off-road EV purchases. The bill reads that, “there shall be allowed as a credit against the tax imposed by this chapter for the taxable year an amount equal […].

CleanTechnica EVs

MARCH 31, 2023

The final version of the rules for the EV tax credit will be issued by the Treasury department on April 18.we we hope.

CleanTechnica EVs

JUNE 4, 2021

As we reported recently, there’s a big cleantech bill moving through the US Congress that would revive, extend, and expand the zero-emission vehicle tax credit in various ways.

CleanTechnica EVs

AUGUST 17, 2022

The US Department of Energy has published a list of vehicles that are eligible for the new EV tax credit until the end of this year.

CleanTechnica EVs

MAY 22, 2021

The bill proposes to accelerate the sunset date of alternative fueled vehicle (electric vehicles and hybrid electric vehicle) tax credits in Louisiana. In essence, they want to end the tax credits earlier than planned. Louisiana’s Ways and Means will hear SB 8 on Monday, May 24.

CleanTechnica EVs

DECEMBER 22, 2022

The Inflation Reduction Act signed into law in August significantly altered the federal tax credit for electric cars. Previously, it was only available for the first 200,000 electric cars manufactured by any one automaker.

CleanTechnica EVs

JUNE 19, 2024

You can now buy the Tesla Model 3 Long Range in the United States and get the full $7500 federal tax credit. That is, of course, if you have that much tax liability. Consult a tax professional before counting on the full $7500 if you are not sure of your.

CleanTechnica EVs

OCTOBER 8, 2023

On January 1, 2024, the federal EV tax credit for new and used electric cars becomes a point of sale rebate for buyers.

CleanTechnica EVs

NOVEMBER 24, 2022

to be a bit loose in determining whether EVs comply with new EV tax credit requirements. Ford wants the U.S. Read on for what’s going on here. Some Background Rare-earth minerals are a big deal.

CleanTechnica EVs

APRIL 19, 2023

The US federal tax credit for electric vehicles has been updated, and that means that some electric cars, trucks, and SUVs no longer qualify for the full tax credit — or even half the tax credit. Actually, most electric vehicles on the market in the United States no longer qualify!

EV Connect

JULY 1, 2024

Fortunately, the Federal government offers the Alternative Fuel Refueling Tax Credit, also known as the “30C” tax credit or EV charging tax credit to offset the burden of installing EV charging. What Are the Benefits of an EV Charging Station Tax Credit? Is anyone excluded from EV tax credits?

CleanTechnica EVs

JANUARY 26, 2024

If you bought a Tesla in 2023 and are looking to get a tax credit from the US government, it. continued] The post Tesla 2023 IRA Document For Tax Credit — How To Get It appeared first on CleanTechnica.

CleanTechnica EVs

DECEMBER 8, 2023

Earlier this month, Ford announced to dealers that the Mustang Mach-E would be losing access to the tax credits it. continued] The post Ford Mustang Mach-E To Lose Tax Credit in January appeared first on CleanTechnica.

Electrek

MAY 28, 2021

This week on the Electrek Podcast , we discuss the most popular news in the world of sustainable transport and energy, including the launch of Tesla Vision, some Tesla Cybertruck news, an update on the electric car tax credit, and more. Thank you to Volkswagen’s new ID.4 4 for sponsoring today’s show!

CleanTechnica EVs

NOVEMBER 27, 2024

continued] The post Elon Musk: Teslas Just Too Expensive For People … But We’re Fine Losing The $7,500 Tax Credit appeared first on CleanTechnica.

Green Energy Consumers

APRIL 26, 2024

As spring 2024 unfolds, we have some good news: more vehicle models are now eligible for the federal tax credit than when the list changed on January 1. Department of Energy recently released a new list of EVs that receive between $3,750 and $7,500 in federal tax credit.

CleanTechnica EVs

MARCH 16, 2024

federal EV tax credit provided that the customer meets all purchase and income qualifications for the EV tax credit as outlined in Internal Revenue Code Section 30DOpens. continued] The post 2024 Nissan LEAF Regains Eligibility for up to $3,750 EV Tax Credit appeared first on CleanTechnica.

CleanTechnica EVs

JANUARY 16, 2024

continued] The post The Real Crime With The US EV Tax Credit — Pushing Larger Vehicles appeared first on CleanTechnica. This kind of automobile favoritism is nothing new in the US. However, I’m having a tough week, and another update.

CleanTechnica EVs

JANUARY 2, 2024

Not only are tax credits dwindling. continued] The post Tax Credits Dwindle, Last Call For A $20,000 Chevy Bolt appeared first on CleanTechnica. With the new year rung in, some big changes are happening in the industry.

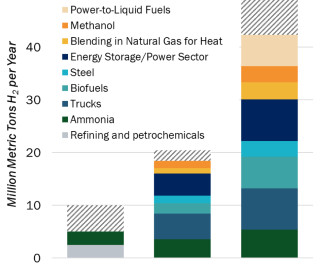

Green Car Congress

JUNE 6, 2023

The Strategy and Roadmap provides a snapshot of hydrogen production, transport, storage, and use in the United States today and a vision for how clean hydrogen will contribute to national decarbonization goals across multiple sectors in the future. Source: DOE. It also complements the massive $9.5-billion It also complements the massive $9.5-billion

Clean Fleet Report

SEPTEMBER 2, 2022

One of the most intriguing of these changes for car buyers is a revamped electric vehicle (EV) tax credit. How Much Can You Get from the EV Tax Credit? The new EV tax credit, like the one that preceded it, offers up to $7,500 for electric passenger cars and light trucks. However, these will change.

CleanTechnica EVs

JUNE 15, 2022

Some experts argue that the current tax credit doesn't begin to address the needs for transitioning to zero emissions, all-electric transportation.

CleanTechnica EVs

AUGUST 8, 2022

Omar Qazi (@WholeMarsBlog on Twitter) has a very interesting take on the recent “Inflation Reduction Act” that is very cynical in regards to the EV tax credit. That doesn’t mean it is wrong, but it does go against my general rule of assuming people have good intentions.

CleanTechnica EVs

APRIL 14, 2023

Consumers have a new resource for finding plug-in electric and fuel cell vehicle tax credits. Oak Ridge National Laboratory researchers have developed an online resource to help consumers understand the electric vehicle tax credits available […]

CleanTechnica EVs

JANUARY 2, 2024

Not only are tax credits dwindling. continued] The post Tax Credits Dwindle, Last Call For A $20,000 Chevy Bolt appeared first on CleanTechnica. With the new year rung in, some big changes are happening in the industry.

Green Car Congress

AUGUST 26, 2013

Georgia has a tax credit worth up to $5,000 for zero-emissions vehicles. San Diego ranks in the top LEAF cities for many of the same reasons in other California and West Coast markets: state tax incentives, HOV/HOT access and general environment-mindedness. area, Maryland offers a $1,000 EV tax credit.

Green Energy Consumers

FEBRUARY 7, 2024

Back in December, we wrote about how the rules for what electric vehicles (EVs) qualify for the federal tax credit were going to change in 2024. Those changes did kick in January 2024, but so did new rules about how to claim the federal tax credit that we hadn’t expected.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content