IRA EV tax credits winning over more auto dealers in 2024

Teslarati

JANUARY 7, 2024

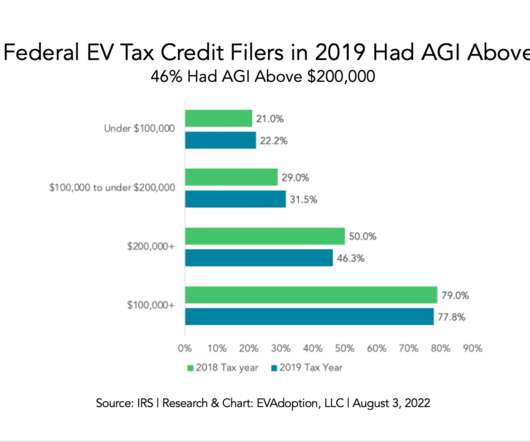

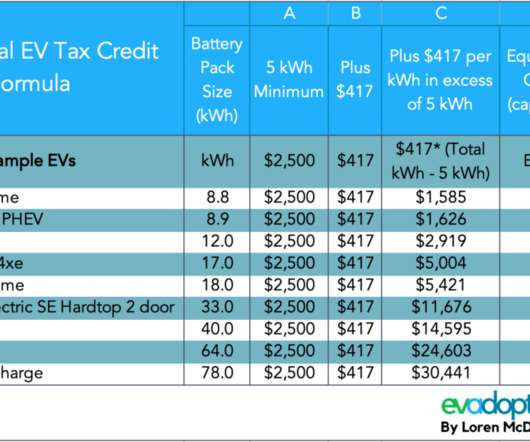

According to the United States (US) Treasury Department, more auto dealers are signing up for the point-of-sale electric vehicle tax credit. In November 2023, the US Treasury announced that car dealers would receive direct tax credit payments, enabling them to offer customers immediate rebates at the point of sale.

Let's personalize your content