What happened to the Tesla Cybertruck & Model 3’s IRA tax credit eligibility?

Teslarati

JANUARY 2, 2024

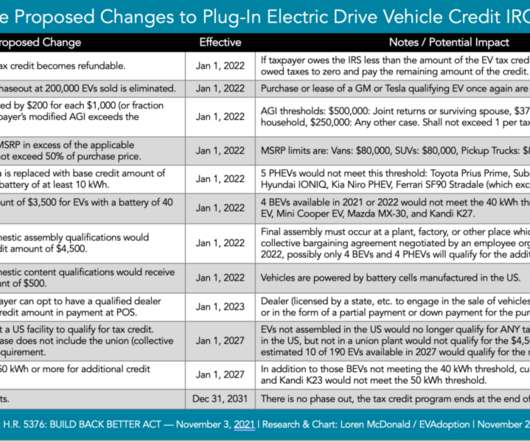

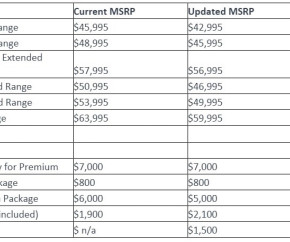

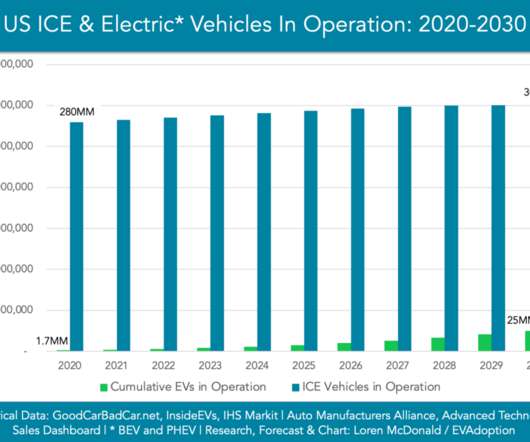

While many Tesla vehicles qualify for the IRA’s tax credits for electric vehicles (EVs), two Model 3 variants and the Cybertruck were left out of the current list. Tesla did not provide a reason for the Model 3 RWD and LR’s exclusion from the IRA tax credits list. The Cybertruck launched late last year in the US market.

Let's personalize your content