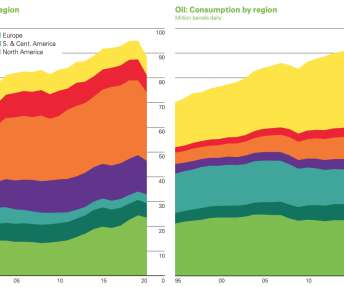

The 5 Countries That Could Push Oil Prices Up

Green Car Congress

OCTOBER 26, 2017

Oil prices appear to be stuck in the $50s per barrel, but that doesn’t mean there aren’t serious supply risks to the market. An unexpected disruption could occur at any moment, as has happened in the past, leading to a sudden and sharp jump in prices. The threat of an outage will carry more weight as the oil market tightens.

Let's personalize your content