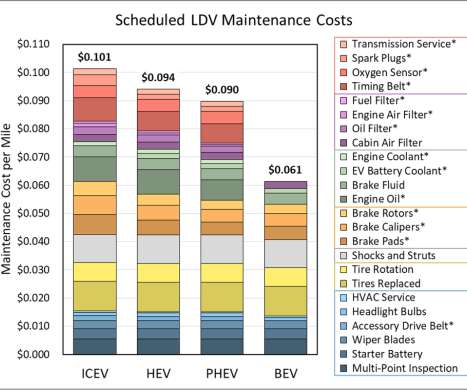

Argonne study finds BEVs can have lowest scheduled maintenance costs, but highest cost of driving

Green Car Congress

JUNE 15, 2021

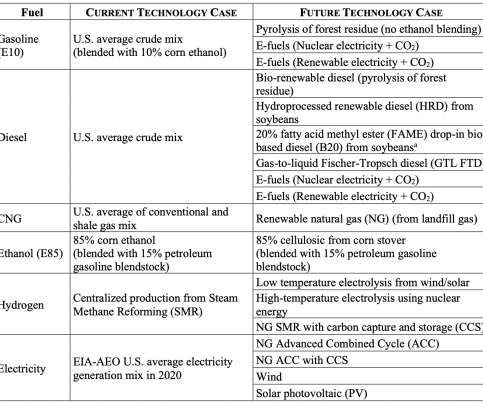

Researchers at Argonne National Laboratory, with colleagues from Lawrence Berkeley, Oak Ridge, and National Renewable Energy labs, and the University of Tennessee, have published a comprehensive analysis of the total cost of ownership (TCO) for 12 sizes of vehicles ranging from compact sedans up to Class 8 tractors with sleeper cabs.

Let's personalize your content