3 Scenarios That Would Make An EV Ineligible For the Federal EV Tax Credit

EV Adoption

NOVEMBER 29, 2021

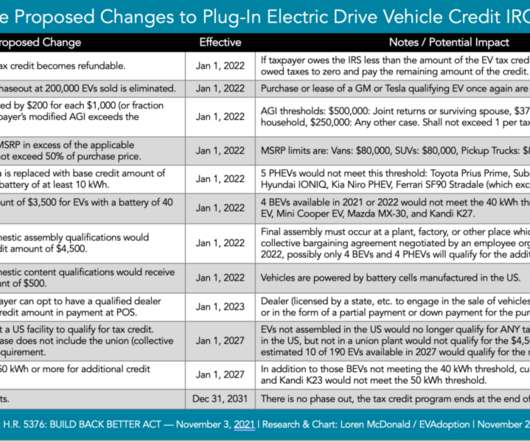

Battery is under 10kWh: Currently only five PHEVs would not meet the proposed 10 kWh threshold: Toyota Prius Prime (8.8 kWh) Subaru Crosstrek Hybrid (8.8 kWh) Hyundai IONIQ PHEV (8.9 kWh) Kia Niro PHEV (8.9 Of these five, the Toyota Prius Prime is the only one that sells in any significant volume.

Let's personalize your content