Tesla Tax Credit: How Californians Can Save $15,000 with EV Credits and Rebates

EV Life

APRIL 7, 2023

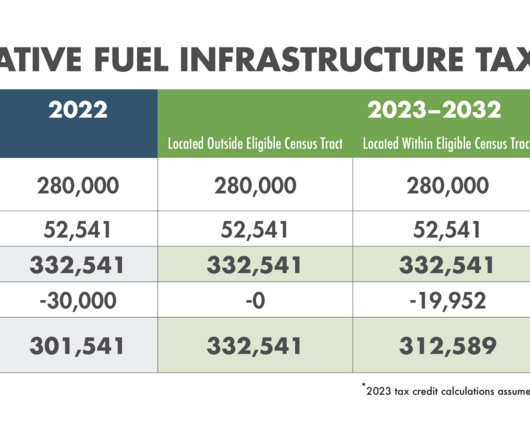

In this article, we’re going to show you how California residents can save over $15,000 on Tesla Model 3 and Model Y by taking advantage of available EV tax credits, rebates, and incentives. The code references a number of eligible vehicles , including the Tesla Model 3 and Tesla Model Y. Not anymore.

Let's personalize your content