The Next Oil Price Spike May Cripple The Industry

Green Car Congress

AUGUST 25, 2017

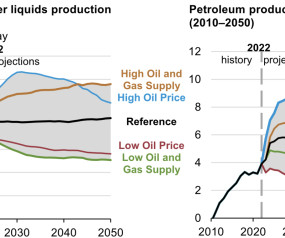

Two diametrically opposed views dominate the current debate about where the oil price is heading. The first is that at present EVs do not yet outperform ICEVs comprehensively. Of course, a number of things could happen that would prevent such an oil supply crunch, and thus an oil price spike. Since (non-U.S.

Let's personalize your content