Electric Vehicle Tax Credit Bill From US Senate Finance Committee Looks Great

CleanTechnica EVs

MAY 27, 2021

The US Senate Finance Committee has put forth a bill to extend and strongly improve the US federal EV tax credit.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CleanTechnica EVs

MAY 27, 2021

The US Senate Finance Committee has put forth a bill to extend and strongly improve the US federal EV tax credit.

The Truth About Cars

MAY 27, 2021

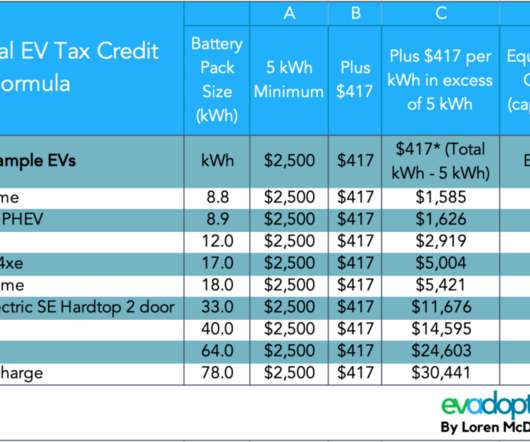

On Wednesday, the Senate Finance Committee advanced the Clean Energy for America Act making a few tweaks from earlier proposals. Changes include raising the federal EV tax rebate ceiling to $12,500 and opening the door for automakers who already exhausted their production quotas.

Green Car Congress

APRIL 2, 2013

Tesla Motors, in partnership with Wells Fargo and US Bank, has created an automotive financing product that combines elements of ownership and leasing for Model S customers. Elements of the new program include: US Bank and Wells Fargo have agreed to provide 10% down financing for purchase of a Model S (on approved credit.).

Green Car Congress

JANUARY 21, 2022

LAND , a startup electric vehicle manufacturer headquartered in Cleveland, began US production on 120 units of the District E Moto this month. The District is a two-wheeled E Moto, a transitional vehicle that performs as an e-bicycle, e-moped, and e-motorcycle through a ride mode selection interface, with a top speed of 65 mph.

Electrek

MAY 27, 2021

A new bill to reform the federal electric car tax incentive in the US has passed the US Senate Finance Committee. It includes increasing the electric vehicle tax credit to up to $12,500, but it was expertly crafted to give less to Tesla vehicle buyers.

Green Car Congress

DECEMBER 19, 2013

Senate Finance Committee Chairman Max Baucus (D-Mont.) introduced the latest in a series of discussion drafts to overhaul the US tax code. This new staff discussion draft focuses energy tax policy on stimulating domestic, clean production of electricity and transportation fuels, which account for 68% of energy consumed in the US.

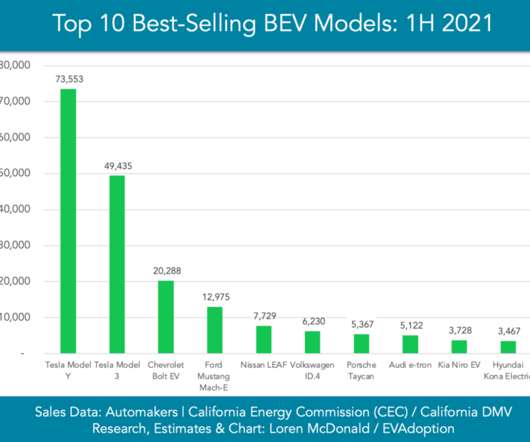

EV Adoption

AUGUST 18, 2021

Arguably the biggest flaw in the Plug-In Electric Drive Vehicle Credit ( IRC 30D ) regulations is the triggering of a phaseout schedule of the tax credit when a manufacturer sells 200,000 total EVs (BEV and PHEV). Elimination of the Manufacturer 200,000 EVs Sold Phaseout Threshold.

Green Car Congress

JANUARY 6, 2014

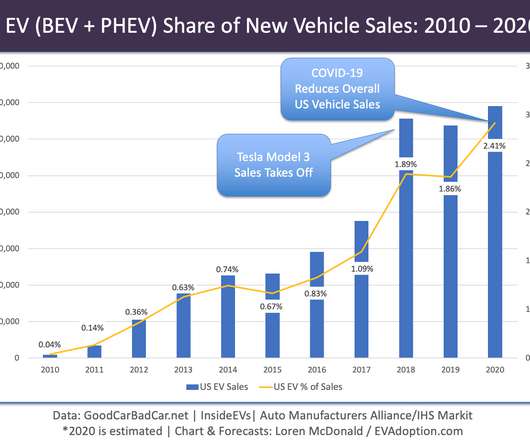

Although sales of plug-in vehicles (plug-in hybrid-electric and battery-electric vehicles, collectively PEVs) in the US climbed more than 80% in 2013 to more than 96,000 units (Tesla has not yet released its final figures) from 52,835 units in 2012 EDTA ), the 2013 results still reflect a meagre new light-duty vehicle market share of ~0.6%

EV Adoption

FEBRUARY 23, 2021

For electric vehicle observers, the legislation contains two key provisions: The first would extend the tax credit to automakers who already reached the current phaseout level of 200,000 EVs sold with another 400,000 vehicles, but with a reduction to $7,000 from the current maximum $7,500 credit.

CleanTechnica EVs

JANUARY 26, 2023

In this article, I will explain how many households don’t have access to the US EV tax credit and some possible solutions. 81 Million (63% Of Households) In US Not Eligible For Full $7,500 Tax Credit I’ve been writing a lot recently about how affordable electric cars are going to be soon.

Green Car Congress

AUGUST 10, 2011

The complete SunPower solar system is offered at a base price of less than $10,000, after federal tax credits. Affordable financing options for the solar system are available through SunPower. This price point does not include local sales tax.

CleanTechnica EVs

JUNE 29, 2024

Reporting on the Tesla Model 3 Long Range gaining eligibility for the $7,500 US tax credit, and then reporting on your “last” chance to get 1.99% APR financing on a Model 3 RWD, I started thinking about how cost competitive the Model 3 has become. But then I remembered that.

Teslarati

SEPTEMBER 14, 2024

As noted by Tesla on the order page of the Model 3 and Model Y , the $0 due at signing promotion applies to financed vehicles when buyers apply for the $7,500 federal tax credit at point of sale OR. Or put 20% down and get 1.99% APR* when you finance a qualifying Model 3 for up to 60 months.

EV Life

JUNE 29, 2023

Great news for drivers looking to purchase an electric vehicle in Colorado! But the most exciting part of the new bill for many Colorado residents is the expansion of an additional Colorado Electric Vehicle Tax Credit for qualified drivers looking to purchase electric vehicles. 4 , and more.

Green Car Congress

APRIL 5, 2022

With opportunities for drivers to earn additional income upon purchasing a new vehicle by having Firefly’s smart display screen technology integrated onto and inside each vehicle, Hyundai Drive by Firefly could help cover monthly car lease/financing costs for qualified drivers and fleets for the duration of the program.

Teslarati

APRIL 28, 2022

Tesla’s electric vehicles are premium-priced, but their financing deals make them quite compelling against their rivals in the EV market. In a way, Tesla’s financing deals involve interest rates that could end up undercutting the costs of rival EVs by a notable degree. It’s not just Toyota either.

Teslarati

MARCH 16, 2024

also offer additional local tax credits on electric vehicles (EVs). also offer additional local tax credits on electric vehicles (EVs). In addition, Tesla is offering 5,000 miles of free Supercharging on all trade-ins , excluding the Cybertruck, used, or commercial vehicles.

Green Car Reports

APRIL 13, 2012

A bill signed in Colorado will now allow lessees to claim any tax credits for hybrid cars and electric vehicles, rather than the lessor. Previously, the state had allowed banks or finance companies to choose whether claim the credits themselves on lease vehicles, or to pass the credits on to the lessee.

Teslarati

MAY 11, 2024

On Friday night, Tesla launched the promotional financing on its website for the Model Y, offering a 0.99 percent APR interest rate for buyers who finance the electric vehicle (EV) on an order placed by May 31.

Green Car Congress

NOVEMBER 30, 2018

Rivian, an electric vehicle manufacturer, unveiled two “Electric Adventure Vehicles”—the R1T, an all-electric pickup and the R1S, an all-electric SUV—at events surrounding the LA Auto Show this week. R1T pricing starts at $61,500 after Federal Tax credit.

EV Connect

AUGUST 2, 2021

Installing electric-vehicle (EV) charging stations on your property can benefit your business in many ways — from attracting customers to luring top talent. And thanks to a variety of tax credits and incentive programs, the barrier to entry may be lower than you think.

Plug in America

JULY 12, 2023

They found all six EVs offer savings in the very first year of ownership when financed. EVs Can Save Up To $12,000 Over Their Lifetime The study considers various factors such as fuel costs, maintenance and repair expenses, purchase price, federal tax credits, financing options, and resale value.

Setec Powerr

APRIL 26, 2023

The global push towards sustainable energy and reducing carbon emissions has given rise to the popularity of electric vehicles (EVs). One such incentive is the electric car tax credit, designed to help offset the initial cost of EVs for buyers. Section 1: Overview of the Electric Car Tax Credit in 2023 1.1

EV Adoption

SEPTEMBER 7, 2021

One of the biggest complaints about the federal electric vehicle (EV) tax credit (IRC 30D) is that its structure of using a non-refundable tax credit is clearly more beneficial to higher-income households. How the Current Tax Credit Works For EV Buyers.

EV Life

JANUARY 4, 2024

It has a truly distinctive futuristic design coupled with some pretty impressive capabilities under the hood and all the available features you would expect from the world’s leading electric vehicle producer. Available EV Incentives Federal Tax Credit. Electric trucks with an MSRP of up to $80,000 may qualify.

EV Life

SEPTEMBER 21, 2023

Chevrolet has taken the electric vehicle market by storm with a number of different EV offerings. After the release of the popular Bolt EV and Bolt EUV , the automaker has continued to expand its electric portfolio to include EV versions of a number of its most popular ICE models. EV Incentive Programs · Federal Tax Credit.

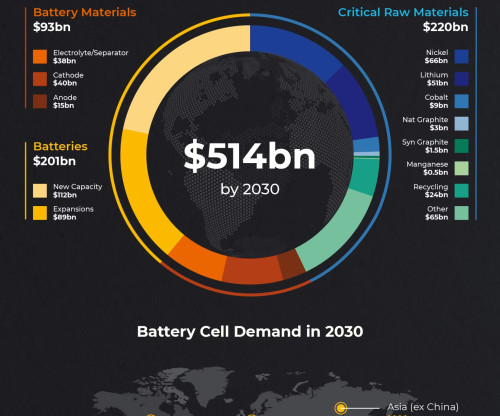

Green Car Congress

JUNE 20, 2023

Most of this growth is driven by an ever increasing demand for electric vehicles. Energy storage might form a relatively small piece of the overall financing required, but it is a strategically critical piece of the puzzle. Demand for lithium ion batteries is forecast to grow to 3.7 Manufacturing the additional 2.7

EV Life

AUGUST 24, 2023

In the dynamic landscape of electric vehicles, the Rivian R1T has emerged as a groundbreaking innovation, redefining the realm of electric adventure trucks. Revolutionizing Adventure: The Rivian R1T Unveiled The Rivian R1T burst onto the scene as a game-changer, setting new benchmarks for electric adventure trucks.

EV Life

SEPTEMBER 14, 2023

In this EV Life electric vehicle spotlight, we’ll explore the trim levels, features, options, and performance of the Ford Mustang Mach-E and find out why it’s one of the hottest EVs of 2023 -2024. We’ll also show you how to save money by financing your purchase through EV Life. Clean Vehicle Rebate Project (CVRP).

EV Life

SEPTEMBER 7, 2023

Release Date: Fall 2023 Starting Price: $30,000 Chevrolet has become a pioneer in the electric vehicle market. Building on the success of the popular and affordable Bolt EV and Bolt EUV , the automaker has continued to expand its electric offerings to include EV versions of several of its most popular models.

Green Car Congress

OCTOBER 12, 2014

For example, eligibility for all or a portion of the federal tax credit is based on the customer’s tax liability, a consideration that is typically unknowable until tax time. Much like the federal tax credit, California’s state rebate introduces multiple levels of uncertainty and risk into the retail transaction.

EV Life

AUGUST 4, 2023

General Motors was one of the original pioneers of electric cars, introducing the EV1 in 1996 and the game-changing Volt in 2010. Chevrolet has continued that trend in the last few years—emerging as a major leader in the electric vehicle industry. Federal, State, and Local EV Incentives Federal Tax Credit.

EV Life

JANUARY 11, 2024

Electric vehicles are becoming more and more common on the roads across the country. With climate change awareness increasing, gas prices continuing to climb, EV charging stations expanding, and tons of new EV options hitting the market each year, it’s no surprise that electric vehicle purchases are skyrocketing.

EV Life

JUNE 28, 2023

The negative impact of fossil fuel emissions on climate change and the environment has become an important issue facing the world today, and some of the biggest contributors are the gas-powered vehicles we drive every day. At the forefront of this electric revolution is Tesla, a company synonymous with innovation and disruptive technology.

EV Life

AUGUST 17, 2023

4 to its plant in Chattanooga, Tennessee, which allowed the popular SUV to join the ranks of EVs that qualify for the $7,500 federal tax credit. 4 has to offer, compare available trims, and take a look at how you can save money with EV incentives by financing through EV Life. In 2023, Volkswagen moved its production of the ID.4

EV Life

AUGUST 10, 2023

We’ll also take a look at the best way to save money when financing your Lightning purchase through an EV Climate Loan with EV Life. There are a variety of programs, grants, and tax credits available to encourage drivers to make the switch to electric vehicles. Colorado Electric Vehicle Tax Credit.

EV Life

APRIL 7, 2023

That’s why it’s no surprise that the high sticker price of many electric vehicles, particularly Tesla models, has long been one of the main deterrents for people looking to buy a new car, truck, or SUV. Tesla’s electric vehicles are by far the most popular EVs in the country. Which brings us to Tesla.

EV Life

AUGUST 24, 2023

This article will explore the Rivian R1S, examining its available models and premium features and showcasing how financing the R1S through EV Life can save you both time and money. Rivian R1S Interior, Exterior & Safety Features The Rivian R1S is a luxurious all-electric SUV that combines performance and design.

EV Life

JULY 5, 2023

Since its release in 2017, the Tesla Model 3 has revolutionized the electric vehicle market. The Model 3’s sleek and sporty design, combined with its practical functionality, makes it one of the most versatile and desirable electric sedans on the EV market. All three versions of the Tesla Model 3 qualify for the tax credit.

EV Life

APRIL 27, 2023

Teslas are by far the most popular electric vehicles in the industry today, controlling over 60% of the EV market. Recently, Tesla has been adjusting the pricing for many of its vehicles, with some models changing four times in just the last month. With so many price cuts and bumps, it can be hard to keep up.

Green Car Congress

FEBRUARY 11, 2023

Redwood will draw upon this milestone-based financing in tranches that support phased construction and allows the company to unlock funding as it accelerates the construction and expansion of its first battery materials campus. This will provide enough battery materials to produce more than one million electric vehicles a year domestically.

Blink Charging

NOVEMBER 16, 2023

To encourage clean and energy-efficient vehicle adoption, the United States government has made significant changes to the Clean Vehicle tax credit, to take effect from January 1, 2024. These changes make it easier for drivers to access tax credits when purchasing clean vehicles.

EV Life

JUNE 15, 2023

So, if you’re like most potential Tesla buyers, you will probably look to finance your Tesla purchase with a loan rather than pay the sticker price upfront. How Financing Through Tesla Works Tesla offers a variety of auto loan financing options for new and used Tesla models through outside lenders.

EV Life

JANUARY 4, 2024

Well, it’s 2024, the changes to the federal EV tax credit have officially taken effect, and it’s a bit of a mixed bag. The list of electric vehicles that qualify for the federal tax credit shrunk from 35 to 14, according to the US Department of Energy. So, if someone ordered a Volkswagen ID.4

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content