Cadillac ELR EREV goes on sale in January, starting price $75,995

Green Car Congress

OCTOBER 11, 2013

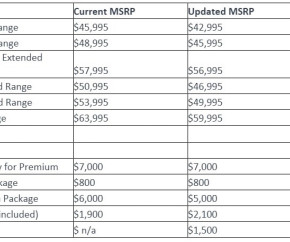

The 2014 ELR has a starting price of $75,995, including a $995 destination charge but excluding tax, title, license and dealer fees. Base price of a 60 kWh Tesla Model S—without Federal tax incentive, but with destination fee—is $71,070.) Official EPA estimates are not yet available. 2014 Cadillac ELR.

Let's personalize your content