Republicans in Congress Want to Put $1,000 Tax on EVs, & Kill the EV Tax Credit

CleanTechnica EVs

FEBRUARY 14, 2025

continued] The post Republicans in Congress Want to Put $1,000 Tax on EVs, & Kill the EV Tax Credit appeared first on CleanTechnica.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CleanTechnica EVs

FEBRUARY 14, 2025

continued] The post Republicans in Congress Want to Put $1,000 Tax on EVs, & Kill the EV Tax Credit appeared first on CleanTechnica.

Green Car Congress

APRIL 11, 2019

US Senators Debbie Stabenow (D-MI), Lamar Alexander (R-TN), Gary Peters (D-MI), and Susan Collins (R-ME) along with Congressman Dan Kildee (MI-05) introduced the Driving America Forward Act, bipartisan legislation to expand the electric vehicle and hydrogen fuel cell tax credits.

Green Car Congress

JUNE 23, 2022

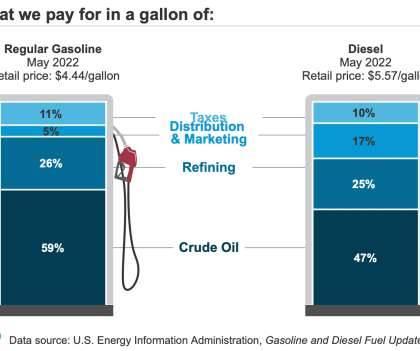

President Biden called on Congress to suspend the federal gas tax for the next 90 days, through the busy summer driving season—18 cents per gallon for gasoline and 24 cents per gallon for diesel. He also called on states to suspend their state gas taxes as well or to find other ways to deliver some relief.

Green Car Congress

DECEMBER 3, 2019

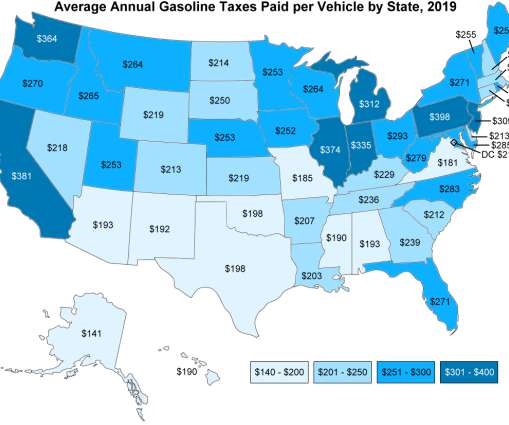

The Federal tax on gasoline is 18.4 cents per gallon, and each state has a gasoline tax, ranging from 8.95 Since taxes are charged on a per-gallon basis, someone with a more efficient vehicle will pay less in taxes over the course of a year. miles per gallon (mpg) and the average annual miles driven is 11,484 miles.

Green Car Reports

JUNE 14, 2022

Although an attempted expansion of the federal EV tax credit has failed—multiple times, in recent years—in a renewed effort, automakers are asking Congress to please try again.

Green Car Congress

JULY 9, 2022

A study by a team from the George Washington University finds that not all financial incentives are created equal in the eyes of prospective car buyers, and the current federal incentive—a tax credit—is, in fact, valued the least by car buyers. The current federal electric vehicle tax scheme is a pain.

Green Car Congress

JUNE 13, 2021

The Connecticut General Assembly has passed HB 6688 , a bill that imposes a highway use tax (HUT) on every carrier for operating, or causing to be operated, certain heavy, multi-unit motor vehicles (Class 8-13) on any highway (i.e., Revenue from the tax is directed to the Special Transportation Fund (STF).

Green Car Congress

MAY 6, 2022

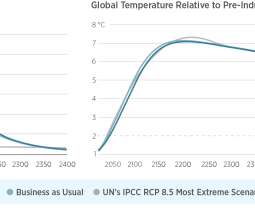

The social cost of carbon has become the standard measure to benchmark the magnitude of the carbon taxes needed to implement optimal carbon policy. If we were able to measure this social cost accurately, standard Pigouvian logic tells us that the optimal tax should be such that the price of carbon is equal to this social cost.

Green Car Congress

SEPTEMBER 29, 2020

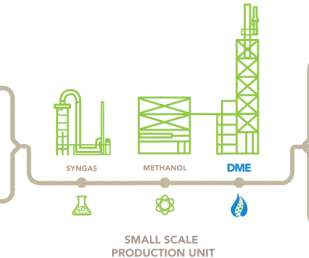

The California state legislature passed and the Governor signed into law a bill ( AB-2663 ) that lowers the Use Fuel Tax rate of dimethyl ether (DME) from $0.18 per gallon of DME-propane fuel blend used on or after 1 July 2021 (the same tax rate as propane, $0.06 per gallon of DME used and $0.06 per gallon).

Green Car Congress

SEPTEMBER 29, 2022

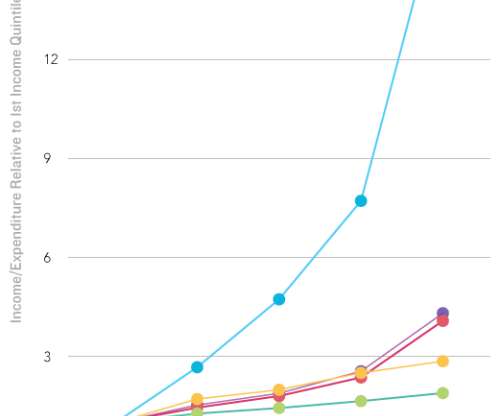

A tax on frequent flying could generate revenues needed to deeply decarbonize aviation through midcentury while concentrating the cost burden on those who fly the most, according to a new study from the International Council on Clean Transportation. The FFL is designed to place an escalating tax burden on people who fly frequently.

Green Car Reports

AUGUST 3, 2022

As Congress moves to extend and expand the federal EV tax credit for passenger cars, it's also considering a bill that would add a first-ever tax credit for electric commercial vehicles.

Green Car Congress

AUGUST 8, 2022

The US Senate has passed the Inflation Reduction Act, with nearly $400 billion in funding over 10 years for climate- and energy-related programs; among the myriad provisions in the 755-page bill are changes to the electric vehicle Federal tax credit of $7,500. At that time, this order process will close.

Green Car Congress

FEBRUARY 24, 2023

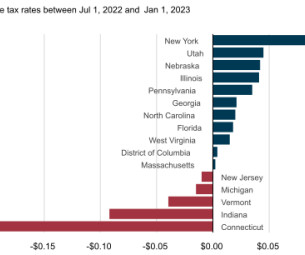

In January 2023, state taxes and fees on gasoline and diesel fuel averaged $0.3163 per gallon (gal) of gasoline and $0.3388/gal of diesel fuel, according to the US Energy Information Administration (EIA). These taxes have increased in 13 states since July 2022. gal), although that low tax rate will gradually increase through May 2023.

Green Car Congress

OCTOBER 22, 2020

The purchase of an XC40 Recharge may qualify for a federal tax credit of up to $7,500. The Volvo XC40 Recharge, the company’s first fully electric vehicle, will carry an MSRP of $53,990 when it arrives in US showrooms later this year. State and local incentives could add further benefits.

Green Car Reports

AUGUST 4, 2021

The federal EV tax credit has thus far only been available for new vehicles, but legislation introduced last week in both houses of Congress could change that.

Green Car Reports

JUNE 24, 2022

President Biden on Wednesday asked Congress for a three-month federal gas-tax holiday. If Congress approves the tax holiday, current federal fuel taxes of 24 cents per gallon for gasoline and 18 cents per gallon for.

Green Car Reports

JULY 29, 2022

Congress appears close to passing a long-awaited extension—and expansion—of the federal EV tax credit. If passed.

Green Car Congress

JANUARY 4, 2019

A research report submitted to the California Legislature this week by the University of California, Davis’ Institute of Transportation Studies proposes switching EVs to a mileage-based road-funding fee (road user charge, RUC) while continuing to have gasoline-powered cars pay gasoline taxes. on-board diagnostic [OBD] devices).

Green Car Congress

AUGUST 9, 2022

The Inflation Reduction Act , which the Senate passed last week, revamps the electric vehicle Federal tax credit of $7,500 ( earlier post ). Among the changes are an extension of the tax credit through 2032, the removal of the unit-sales cap of 200,000 per OEM, and a new mandate for qualified cars being assembled in North America.

Green Car Congress

MAY 4, 2023

Pyka, a developer of autonomous electric aviation technology, was awarded a $7-million California Competes Tax Credit with the California Governor’s Office of Business and Economic Development (GO-Biz), approved last week by the California Competes Tax Credit Committee.

Green Car Congress

AUGUST 10, 2021

In an effort to decarbonize transportation and reduce aviation emissions, Congress is considering new legislation to establish a tax credit to promote and develop robust domestic SAF production. To ensure clarity, we recommend that Congress designate a baseline carbon intensity value for fossil jet fuel.

Green Car Congress

NOVEMBER 7, 2022

The US Department of the Treasury and the Internal Revenue Service (IRS) have released three notices requesting public input on several tax credit provisions in the Inflation Reduction Act (IRA). These include: Credits for Clean Hydrogen Production (45V) and Clean Fuel Production (45Z) ( Notice 2022-58 ).

CleanTechnica EVs

JANUARY 1, 2023

There’s something that’s been bugging me the last couple of days on social media. I don’t mean bugging me a little. I also don’t mean bugging me like Steve Urkel bugs Carl Winslow on Family Matters (in other words, a lot).

Green Car Congress

JANUARY 6, 2020

After the US federal tax credit is applied, the cost of the Fisker Ocean drops to a starting price of US$29,999 (US). Fisker is pricing its new Ocean electric SUV with an MSRP of US $37,499. Reservations are now open through the Fisker mobile app on the App Store and Google Play store, or the Fisker website and are set at US$250.

Green Car Congress

OCTOBER 13, 2019

France’s Constitutional Council, the highest constitutional authority in the country, ruled in favor of excluding palm oil from the list of biofuels that enjoy tax incentives. The decision enters into force on 1 January, 2020. Oil company Total has estimated it is worth between €70 million and €80 million per year.

Green Car Congress

DECEMBER 7, 2020

Prices for classic electric Range Rovers by Lunaz start at £245,000 (US$329,000) excluding local taxes. The company, based in Silverstone, England will create an initial run of 50 of the luxury SUVs built in the ‘classic era’ between 1970 and 1994.

Green Car Congress

FEBRUARY 10, 2022

In a study published in Nature Climate Change , an international research team reports finding limited evidence that individual or household rebates have increased public support for carbon taxes in Canada and Switzerland. 2022) “Limited impacts of carbon tax rebate programmes on public support for carbon pricing.” Mildenberger, M.,

Electrek

FEBRUARY 5, 2025

A coalition of clean energy groups representing over 2,000 companies and hundreds of billions in private investment is holding more than 100 meetings today with bipartisan members of Congress to underscore the critical role of IRA clean energy tax credits.

Green Car Congress

MAY 21, 2021

The legislation would create a tax credit starting at $1.50 The tax credit would expire at the end of 2031. With a long-term, performance-based Blender’s Tax Credit for SAF, we will be able to invest in and produce SAF at scale across the US. gallon for each percentage the fuel reduces emissions over 50%.

CleanTechnica EVs

AUGUST 3, 2022

This bill would establish a federal tax credit for businesses to purchase electric and plug-in hybrid […].

Green Car Congress

APRIL 1, 2021

Giving consumers point of sale rebates and tax incentives to buy American-made EVs, while ensuring that these vehicles are affordable for all families and manufactured by workers with good jobs. Electrifying the federal fleet, including that of the United States Postal Service. Climate science and clean energy.

Green Car Congress

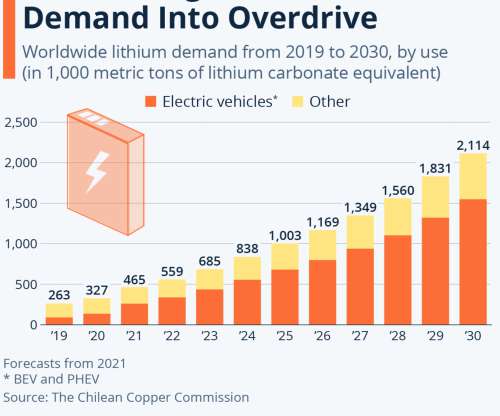

AUGUST 21, 2022

In the US, demand for new energy vehicles is set to increase as the newly passed “Inflation Reduction Act” extends tax breaks for new electric vehicle purchases—although eligibility for the tax break will be determined by the sourcing of critical materials, including lithium. Earlier post.).

Green Car Congress

MAY 23, 2023

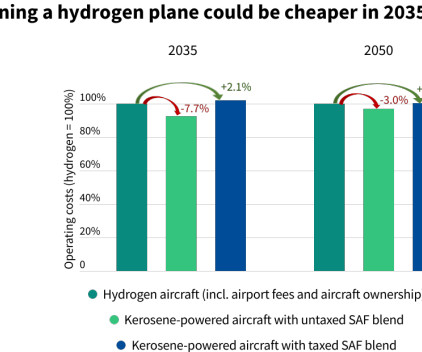

An economic study by research group Steer, and commissioned by T&E, looked at future operating costs of hydrogen planes on intra-European flights and found that they could be an efficient, cost competitive technology to decarbonize the sector, provided kerosene is taxed adequately. (If GJ—approximately €0.37/L.)

Green Car Congress

SEPTEMBER 13, 2021

There are tax incentives in most European countries. For example, in France since the end of July 2021, the incentive for purchasing or renting a new electric LCV is €5,000 inclusive of tax (for a new electric LCV. In addition, a number of cities offer free or reduced-rate parking. ë-Berlingo van range.

Green Car Congress

FEBRUARY 24, 2021

We’re proposing solutions that would recover system costs through sales or income taxes, or an income-based fixed charge, which would pay for long-term capital costs while ensuring all those who use the system—and specifically, wealthier households—contribute equitably.

Green Car Congress

SEPTEMBER 10, 2020

The Lucid Air will be available initially in North America, offered in four model ranges: The Air, the starting point for the lineup, available in 2022 and starting below $80,000 ($72,500 after USA federal tax credit). The well-equipped Air Touring model, available late 2021, from $95,000 ($87,500 after USA federal tax credit).

Green Car Congress

JUNE 16, 2021

million in conditional tax credits based on the company’s job creation plans. These tax credits are performance-based, meaning the company is eligible to claim incentives once Indiana residents are hired. Joseph County has also confirmed $775K in county tax incentives.

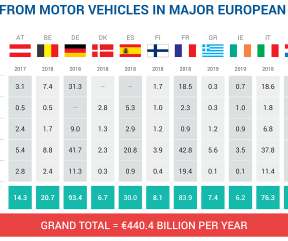

Green Car Congress

MAY 4, 2020

The taxes fall into three broad categories: vehicle acquisition (VAT, sales tax, registration tax); ownership (annual circulation tax, road tax); and motoring (fuel tax). Motor tax revenues collected by governments have increased by almost 3% compared to the previous year, and the grand total of €440.4

Green Car Congress

JUNE 6, 2022

Chevrolet EVs are not eligible for the $7,500 US federal tax credit. Chevrolet, which resumed production of the Bolt electric vehicles in April, has announced that the upcoming 2023 Bolt models will be priced significantly lower than their predecessors. 2023 Bolt EV. 2023 Chevrolet Bolt EUV Redline Edition.

Green Car Congress

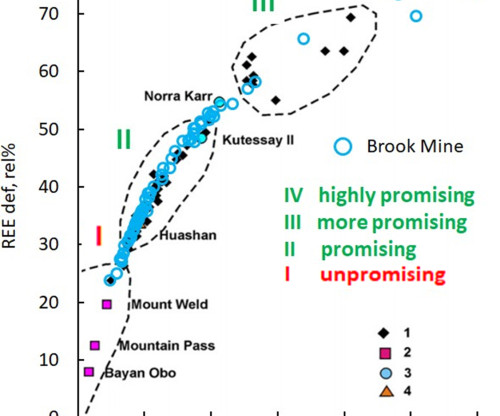

MAY 4, 2023

Congress and the Department of Energy have earmarked billions of dollars toward this goal, and a bipartisan bill introduced earlier this year would establish tax credits to support the production of magnetic REEs like those found at the Brook Mine.

Green Car Congress

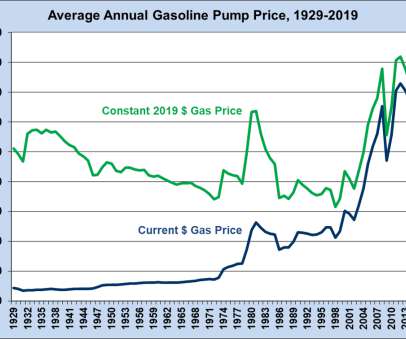

DECEMBER 22, 2020

Note: Retail price includes Federal and State Taxes. From 2002 to 2008, the price of gasoline rose substantially, but then fell sharply in 2009 during the economic recession. In 2012, prices reached the highest level in both current and constant dollars but began a steep decline thereafter.

Green Car Congress

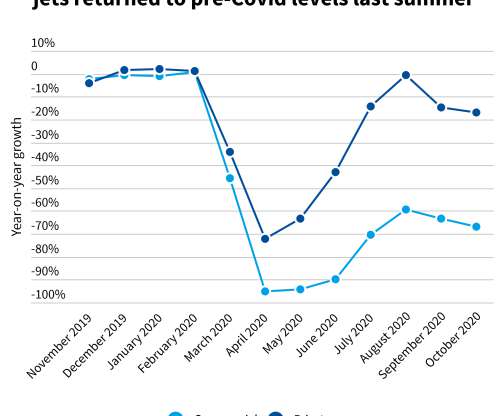

MAY 28, 2021

T&E calculates that a jet fuel tax applied proportionately to flight distances could raise €325 million if applied to all flights departing from the EU and UK. European policymakers need to urgently start taxing fossil-fuel powered private jets and ban their use by 2030.

Electrek

FEBRUARY 14, 2025

Clean energy investments took a serious hit in January, sinking to their lowest point since the Inflation Reduction Act (IRA) supercharged the industry with tax credits and incentives.

Green Car Congress

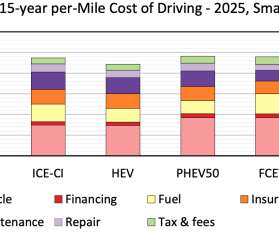

AUGUST 14, 2021

Key findings include insights into vehicle depreciation, an in-depth examination of insurance premium costs, comprehensive maintenance and repair estimates, an analysis of all relevant taxes and fees, and considerations of specific costs applicable to commercial vehicles.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content