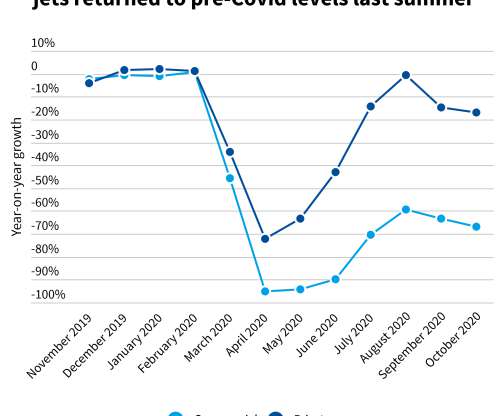

US COVID-19 mitigation efforts resulting in significant decline in traffic, emissions and fuel-tax revenues

Green Car Congress

MAY 2, 2020

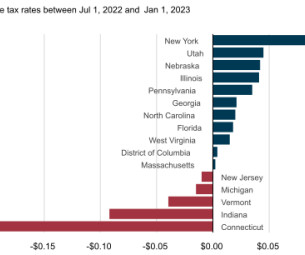

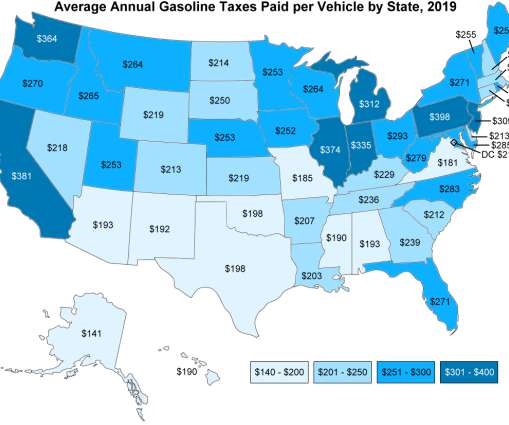

Fuel use dropped from 4.6 It also resulted in fuel-tax revenue reductions, which vary by state. In California, where vehicle miles dropped more than 75%, the state’s fuel-tax revenue under Senate Bill 1 (2017) also plummeted from $61 million in early March to $15 million for the second week of April.

Let's personalize your content