USGS records nonfuel mineral production jump of $3.6B in 2022

Green Car Congress

FEBRUARY 3, 2023

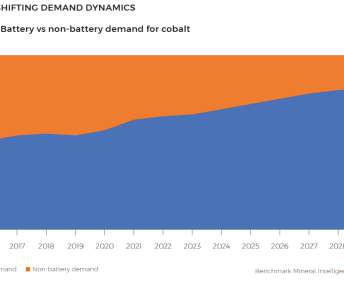

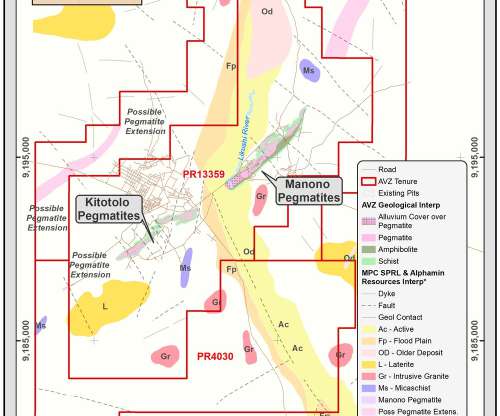

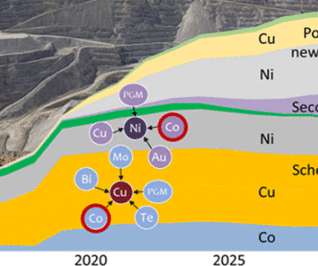

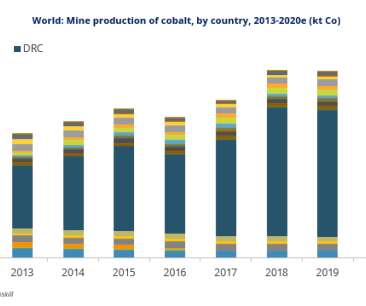

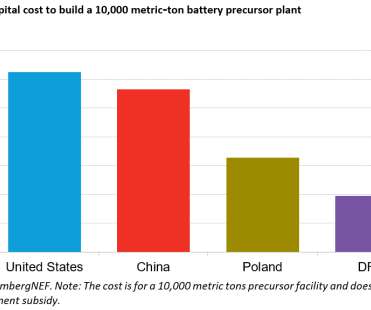

billion value of nonfuel mineral commodities produced by US mines in 2022 included other industrial minerals and natural aggregates, as well as ferrous and nonferrous metals. The estimated value of US production of all industrial minerals in 2022 was $63.5 US mines produced approximately $98.2 Critical minerals.

Let's personalize your content