Ford, LG set to move EV battery production from Poland to Michigan

Baua Electric

OCTOBER 26, 2024

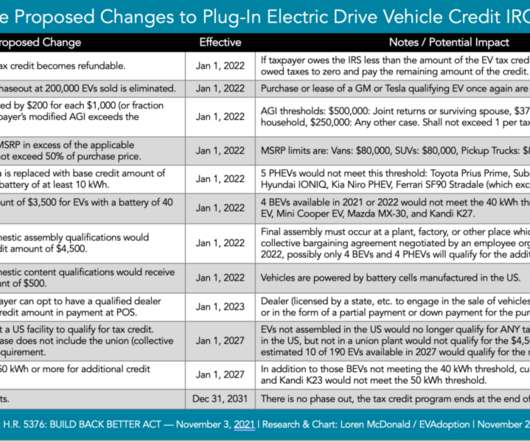

This (of course) has everything to do with the IRA and tax credits. “To Over in Europe, LG plans to take advantage of incentives over there by supplying a total of 109 GWh of batteries to Ford for its electric commercial vans starting in 2026. Electrek’s Take Ford Mustang Mach-E, F-150 Lighting; via Ford.

Let's personalize your content