US COVID-19 mitigation efforts resulting in significant decline in traffic, emissions and fuel-tax revenues

Green Car Congress

MAY 2, 2020

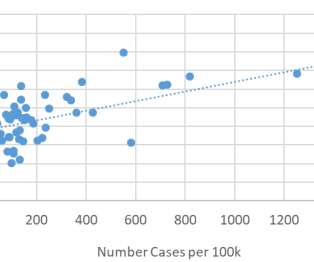

If traffic remained reduced for one year, the reduction in VMT would allow California to meet half of its 2050 climate change target. Fuel saved, tax revenue lost. Fuel use dropped from 4.6 It also resulted in fuel-tax revenue reductions, which vary by state. UC Davis Road Ecology Center). (UC

Let's personalize your content