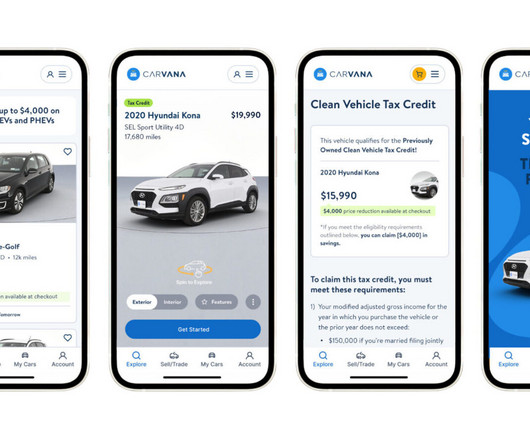

How to Get the Federal Clean Vehicle Tax Credit This Year

Blink Charging

JANUARY 11, 2024

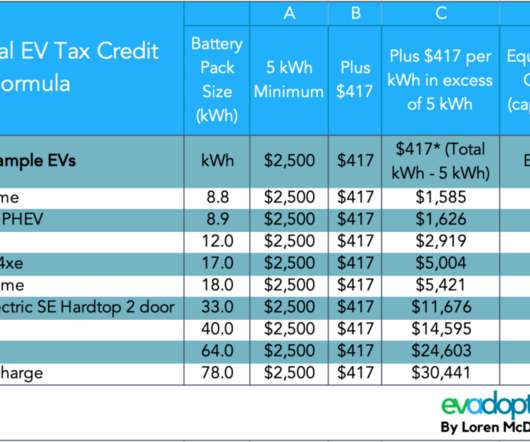

The latest Clean Vehicle Tax Credits can be applied to the purchase of a new or used EV at the point of sale as of January 1, 2024. The Clean Vehicle Tax Credit for new EVs is worth up to $7,500 and the Previously Owned Clean Vehicle Tax Credit is worth up to $4,000.

Let's personalize your content