All The EVs And PHEVs That Lost The Federal Tax Credit In 2025

InsideEVs

JANUARY 3, 2025

The Chrysler Pacifica minivan is now the only PHEV that qualifies for a tax credit. Meanwhile, the Rivian R1T and R1S are out.

InsideEVs

JANUARY 3, 2025

The Chrysler Pacifica minivan is now the only PHEV that qualifies for a tax credit. Meanwhile, the Rivian R1T and R1S are out.

Teslarati

JANUARY 2, 2024

electric vehicle (EV) tax credit have taken effect, significantly limiting the number of qualifying options in 2024. Despite the list of qualifying EVs getting shorter , the 2024 guidance also lets sellers offer the rebate at the point of sale , rather than buyers being forced to wait until doing their taxes.

Teslarati

DECEMBER 29, 2022

EV tax credit. The Internal Revenue Service (IRS) announced the vehicles that qualify for the 2023 EV tax credit. federal tax credit includes EVs made by fourteen manufacturers. The full list is as follows: 2023 Audi Q5 TFSI e Quattro (PHEV). 2022, 2023 Chrysler Pacifica PHEV.

CleanTechnica EVs

JUNE 4, 2021

As we reported recently, there’s a big cleantech bill moving through the US Congress that would revive, extend, and expand the zero-emission vehicle tax credit in various ways.

Teslarati

AUGUST 17, 2022

Department of Energy’s Alternative Fuels Data (DOE) published a list of electric vehicles that are immediately available for the new $7,500 EV tax credit. Under the new law, only EVs assembled in North America qualify for the credits. Chrysler Pacifica PHEV. Ford Escape PHEV. Jeep Grand Cherokee PHEV.

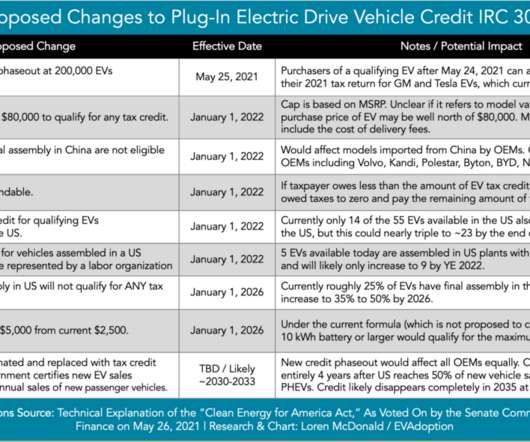

EV Adoption

AUGUST 18, 2021

A key component of the CEAA is nine proposed changes to the Plug-In Electric Drive Vehicle Credit ( IRC 30D ) — more commonly known as the “federal EV tax credit.”. I’ve written extensively on the tax credit and especially its many flaws, ineffectiveness, and areas in the regulations that desperately need fixing.

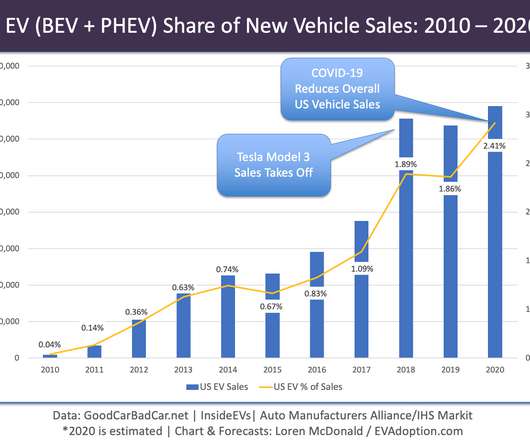

EV Adoption

FEBRUARY 23, 2021

For electric vehicle observers, the legislation contains two key provisions: The first would extend the tax credit to automakers who already reached the current phaseout level of 200,000 EVs sold with another 400,000 vehicles, but with a reduction to $7,000 from the current maximum $7,500 credit.

Let's personalize your content