DOE labs study on costs and benefits of new transportation technologies the most comprehensive to date

Green Car Congress

AUGUST 14, 2021

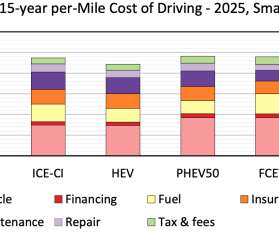

They are newer to the road, so it was hard to know, for instance, their historic needs for maintenance over their operational life. The study finds, for example, that battery electric vehicles have maintenance costs 40% lower than ICE vehicles. Levelized cost of driving (LCOD) across powertrains for light-duty SUV, MY 2025.

Let's personalize your content