Study finds EV buyers want rebates, not tax credits; government could have saved $2B

Green Car Congress

JULY 9, 2022

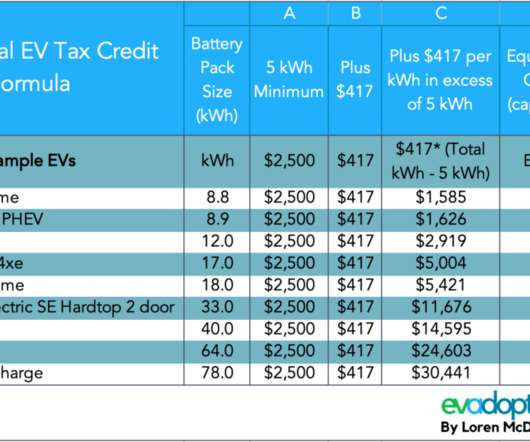

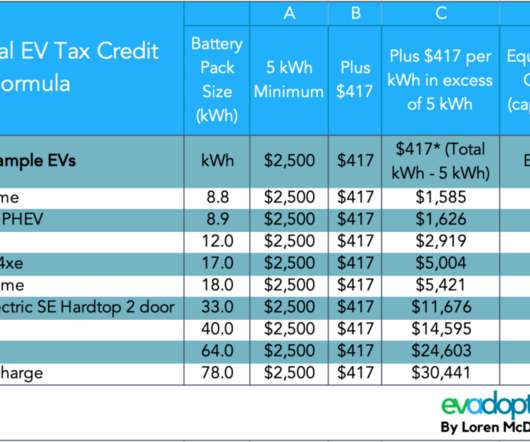

A study by a team from the George Washington University finds that not all financial incentives are created equal in the eyes of prospective car buyers, and the current federal incentive—a tax credit—is, in fact, valued the least by car buyers. —Roberson and Helveston (2022). —John Helveston. Roberson et al.

Let's personalize your content