Starting Jan. 1, it will be easier and cheaper to buy a new or used EV

Plug in America

OCTOBER 11, 2023

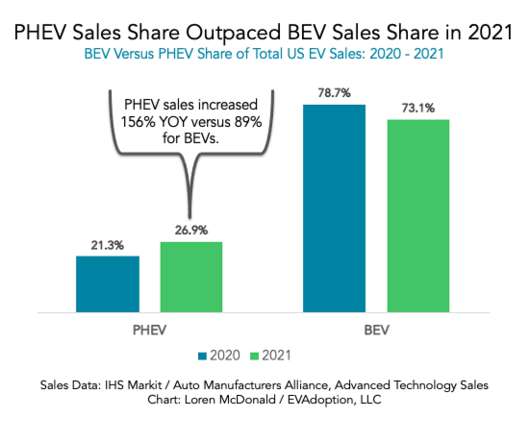

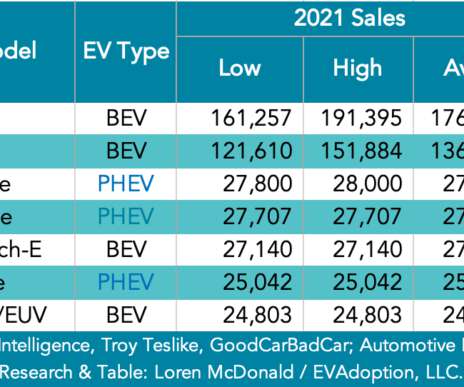

It means that when you purchase an eligible electric vehicle (EV) or Plug-In Hybrid Electric Vehicle (PHEV) and if you meet the income requirements, you get the FULL amount of the tax credit up front. So depending on the vehicle, you could get $3,750, $4,000 or $7,500 off of the purchase price. What does this mean? 1, 2024).

Let's personalize your content