How Government Incentives Help Convenience Stores Install Electric Vehicle Chargers

Blink Charging

FEBRUARY 15, 2024

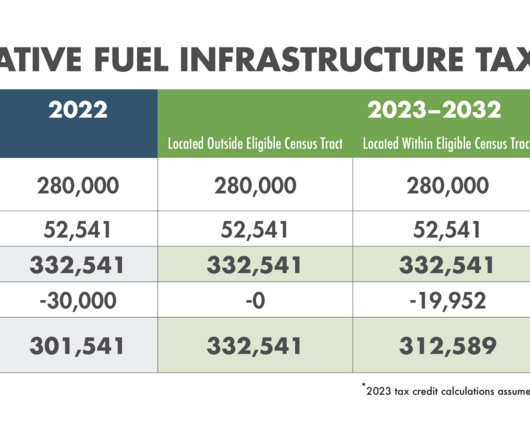

And this is where truck stops and roadside convenience stores come into play. To help c-stores and gas stations install EV charging stations, there are two major federal funding programs that can reduce project costs. What are the best EV chargers to install at a truck stop or roadside convenience store? Ready to get started?

Let's personalize your content