GM expects Chevrolet Silverado EV to get full $7,500 tax credit

Teslarati

APRIL 17, 2023

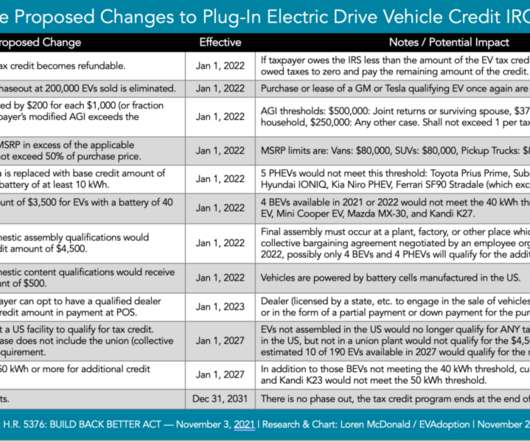

General Motors (GM) expects the Chevrolet Silverado EV to get the Inflation Reduction Act’s (IRA) full $7,500 tax credit. The legacy automaker recently announced that its customers will benefit from the full $7,500 clean vehicles purchase incentive across its entire EV fleet lineup under a given MSRP cap.

Let's personalize your content