Which EVs Still Qualify for Federal Tax Credits?

The Truth About Cars

APRIL 17, 2023

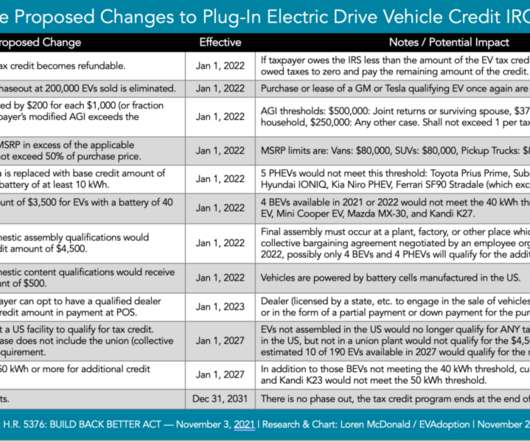

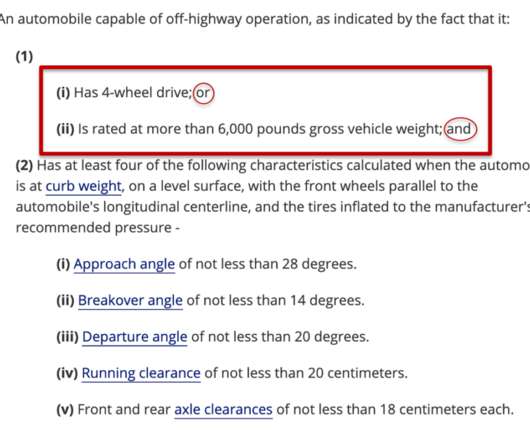

With the guidance having come in on the United States’ updated EV tax credit scheme, outlined in the so-called Inflation Reduction Act, we now have a pretty good idea of which electric vehicles still qualify. Alternatively, the batteries can be produced from materials recycled in North America. or in a country where the U.S.

Let's personalize your content