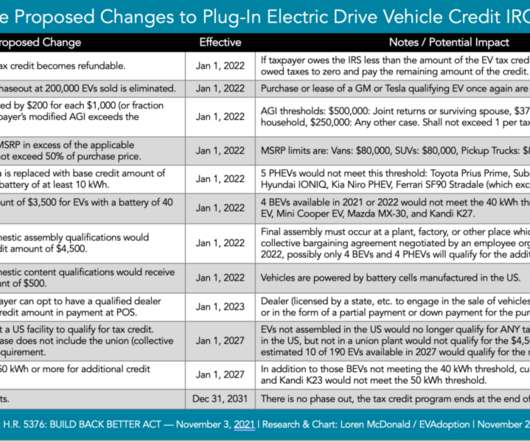

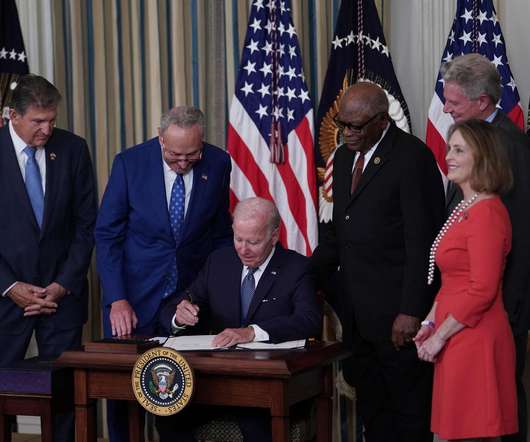

Zero EVs May Qualify For the Federal Tax Credit Under the Inflation Reduction Act Requirements

EV Adoption

AUGUST 4, 2022

Additionally, the IRA could actually receive enough votes to pass, but not without potentially several significant changes — including to some of the EV tax credit requirements. Battery Material and Component Requirements Cannot Be Met in the Near Term. Joe Manchin, via the Wall Street Journal. in effect with the U.S.

Let's personalize your content