GM expects Chevrolet Silverado EV to get full $7,500 tax credit

Teslarati

APRIL 17, 2023

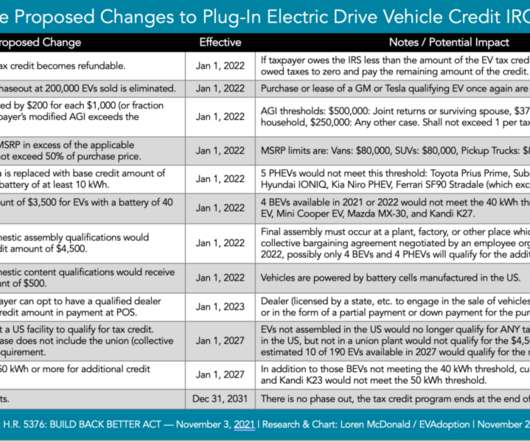

General Motors (GM) expects the Chevrolet Silverado EV to get the Inflation Reduction Act’s (IRA) full $7,500 tax credit. Fleet customers including for BrightDrop and the Chevrolet Silverado EV will benefit from the $7,500 commercial incentive,” stated General Motors. The Ultium line will likely adhere to the U.S.

Let's personalize your content