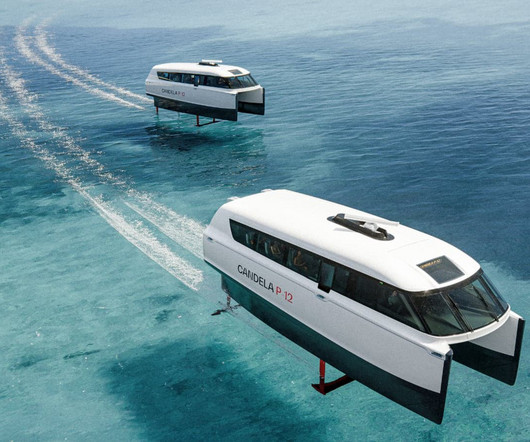

DOE labs study on costs and benefits of new transportation technologies the most comprehensive to date

Green Car Congress

AUGUST 14, 2021

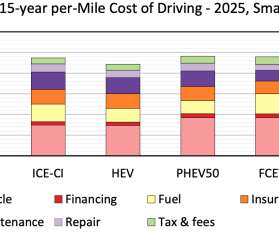

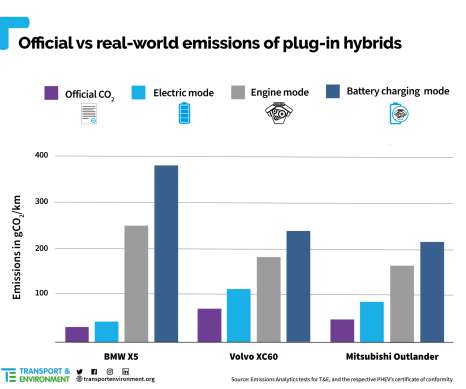

The study looked at several powertrains: internal combustion engine, hybrid electric vehicle, plug-in hybrid electric vehicle, fuel cell electric vehicle and battery electric vehicle. The study finds, for example, that battery electric vehicles have maintenance costs 40% lower than ICE vehicles. —David Gohlke.

Let's personalize your content