How New Eligibility Criteria for the Electric Vehicle Tax Credit Affects You

Blink Charging

DECEMBER 15, 2023

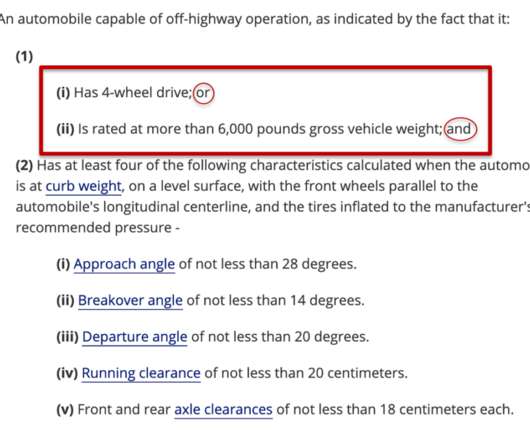

Opting for an electric vehicle and leveraging the EV tax credit to help with your next electric vehicle purchase is a smart move. Initial $3,750 Tax Credit : If you want to secure the first half of the tax credit, your new vehicle’s battery components need to be made or assembled in North America.

Let's personalize your content