The US Treasury released EV charger tax credit guidance – here’s how to find out if you qualify

Baua Electric

MARCH 11, 2024

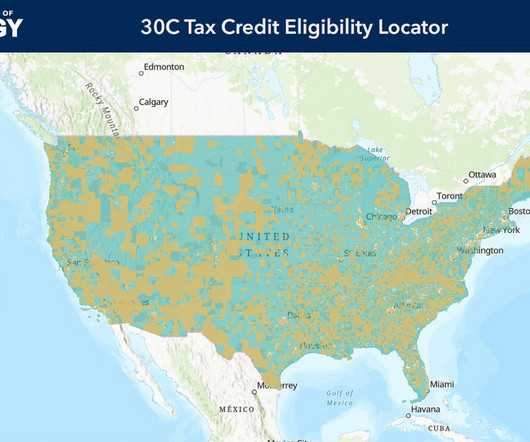

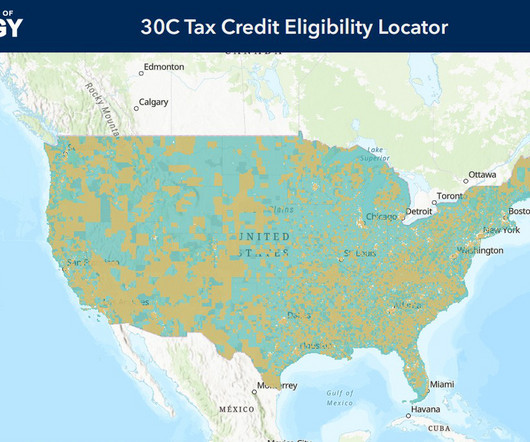

Map: US Department of Energy The US Treasury Department released updated guidance on EV charger tax credit eligibility for individuals and businesses – we’re reposting this story because it’s tax season. Note that there’s a disclaimer on the map that says it’s not formal IRS guidance – and neither is this article!

Let's personalize your content