Fisker finesses the Inflation Reduction Act tax credit changes with binding sales contract; “Transition Rule”

Green Car Congress

AUGUST 8, 2022

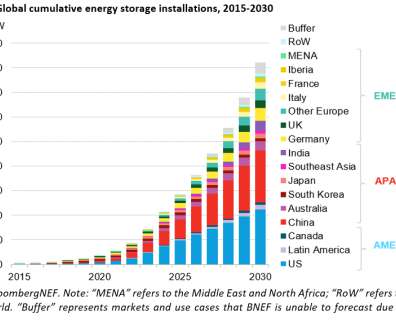

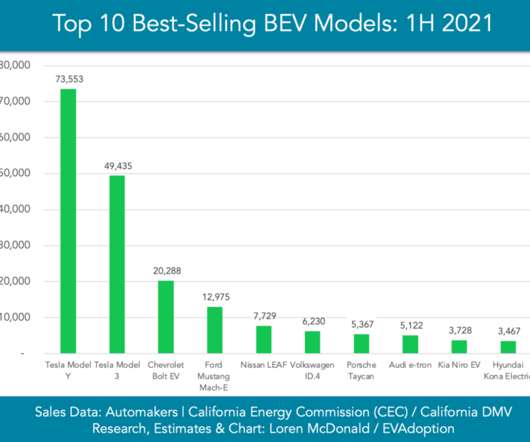

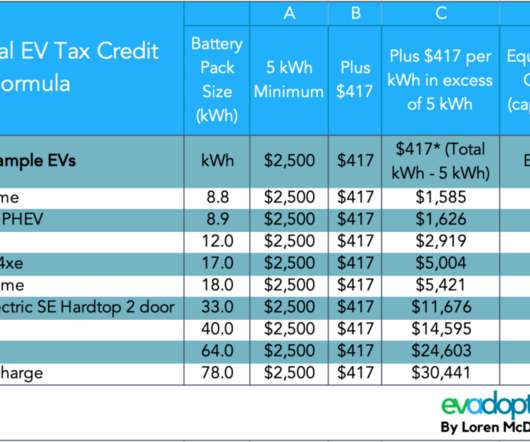

The US Senate has passed the Inflation Reduction Act, with nearly $400 billion in funding over 10 years for climate- and energy-related programs; among the myriad provisions in the 755-page bill are changes to the electric vehicle Federal tax credit of $7,500. The credit will be available at the point of sale.

Let's personalize your content