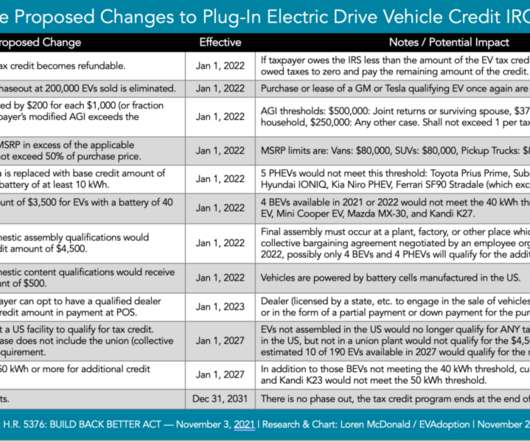

Buying an EV? You won’t have to wait for your tax credit anymore in 2024

Teslarati

OCTOBER 6, 2023

Government expanded the electric vehicle tax credit program and access to those credits to help dealers expand their businesses and consumers take advantage of cost savings for buying an EV. The post Buying an EV? On Friday, the U.S.

Let's personalize your content