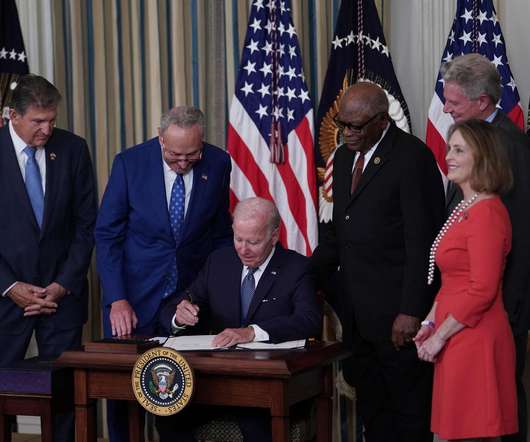

Who Can Claim an EV Charging Station Tax Credit?

EV Connect

JULY 1, 2024

Fortunately, the Federal government offers the Alternative Fuel Refueling Tax Credit, also known as the “30C” tax credit or EV charging tax credit to offset the burden of installing EV charging. What Are the Benefits of an EV Charging Station Tax Credit?

Let's personalize your content