Will EV tax credit price caps add urgency to arrival of affordable models?

Green Car Reports

AUGUST 7, 2022

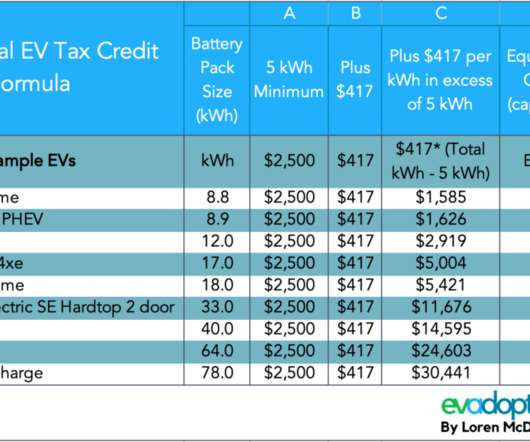

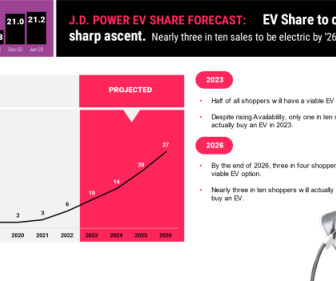

Price caps included with a proposed revamped federal EV tax credit could put pressure on automakers to produce more affordable electric models, argues a new Bloomberg report. An extension of the $7,500 credit reportedly has a good chance of moving through the Senate.

Let's personalize your content