Tesla Semi will be incredibly affordable with US’ revamped EV tax credit

Teslarati

JULY 29, 2022

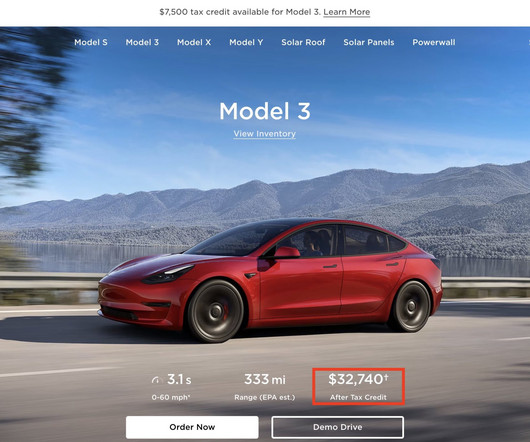

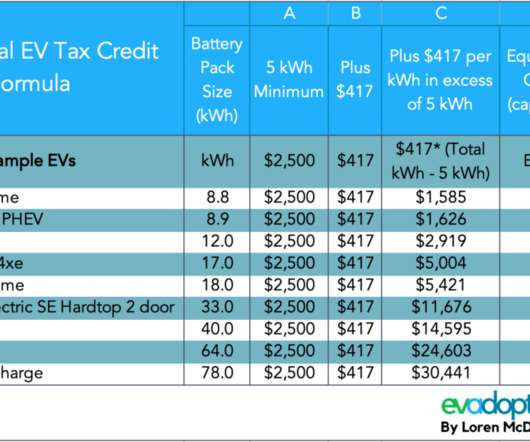

With the Schumer-Manchin reconciliation bill or the Inflation Reduction Act of 2022 , vehicles like the Tesla Semi will have more than a fighting chance in the market. The bill allocates $369 billion for programs that help fight climate change and preserve the environment, and it also includes a number of revamped EV tax credits.

Let's personalize your content