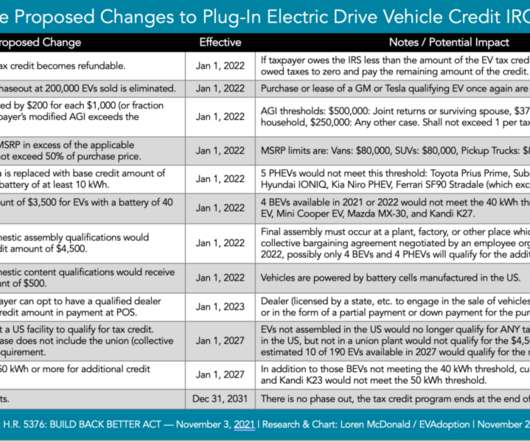

EV tax credit supply chain rules ease, but China restrictions remain

Baua Electric

MAY 3, 2024

In a coordinated push through federal agencies, the Biden administration on Friday released a revised set of regulations applying to the EV tax credit that will ultimately make the credit easier to claim for a wider range of vehicles in 2025 and 2026 but no easier for Chinese companies to gain a foothold on the market.

Let's personalize your content