US Shale Is Immune To An Oil Price Crash In 2017

Green Car Congress

MAY 18, 2017

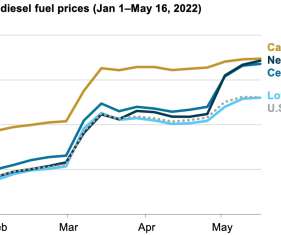

shale in particular—is effectively capping the oil price gains from that agreement. Four months after the OPEC/NOPEC deal took effect, oil prices dropped to the levels preceding the agreement, amid concerns over still stubbornly high inventories and rising U.S.

Let's personalize your content